About Montcrest

Vision

Mission

Values

The Montcrest Story

Our success is attributed to our proactive approach to acquiring value-add opportunities and executing an active asset management plan. By prioritizing timely acquisitions and enacting our strategic asset management plan, we consistently create value for our partners.

Who We Are

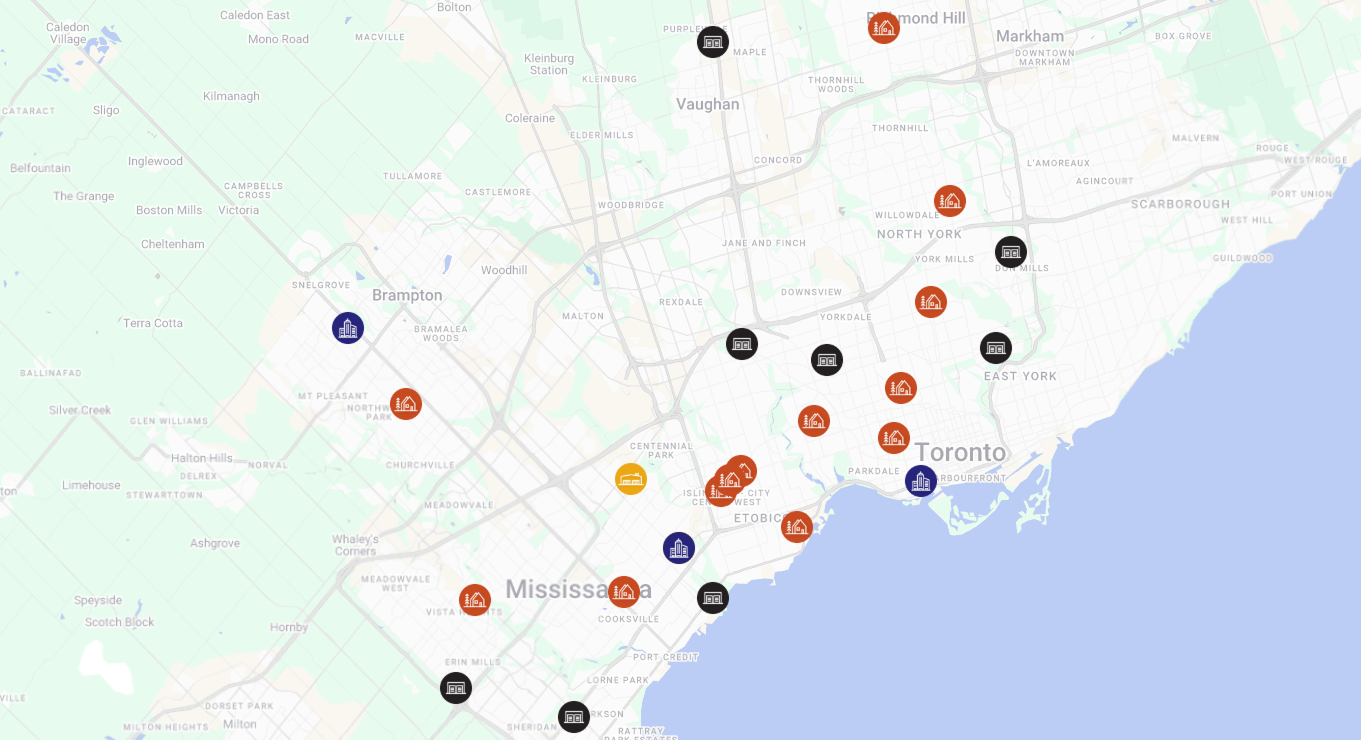

Headquartered in Toronto, Ontario, we proudly own, manage, and invest in exceptional, strategically positioned assets throughout Canada. Guided by experienced leadership and a time-tested management platform, we generate premium, risk-adjusted returns for our partners.

At Montcrest, we remain steadfast in our commitment to unlocking the untapped potential of real estate through innovative value creation strategies and operational excellence.

What We Do

We go beyond traditional real estate opportunities

How we do business

Source

We tap into our strategic Canadian relationships to uncover investment opportunities.

Our approach emphasizes off-market transactions to achieve the return expectations of our partners.

Acquire

We assess every opportunity based on suitability, risk, and scalability and perform due diligence.

We ensure proper alignment and use our expertise to optimize the capital stack by sourcing the right mix of debt and equity to maximize returns with efficiency.

Manage

We administer, manage, and execute all projects internally to ensure maximum opportunity with optimized resources.

Our external service partners are strategically selected for their aptitude and commitment to deliver exceptional results. We offer institutional-level reporting and maintain governance measures to ensure transparency and accountability in all our operations.

Dispose

Upon realization of the business plan, Montcrest will exit the investment and provide returns to our partners.

At Montcrest, our partners can take advantage of our value-driven approach

True partner with aligned interests

Our approach involves being a true partner in every deal we undertake. We invest our own capital into projects, ensuring we are aligned with our partners, prioritizing profitable returns over business or portfolio growth.

Own various asset classes with ease

Montcrest pursues unique opportunities across diverse areas empowering our partners to allocate capital in various asset classes and operating ventures.

Get institutional-level reporting

Our project management includes institutional-level reporting, and we have established proper governance measures.

Experienced Management Team

A team with extensive, specialized knowledge, execution experience and proven track record.

Proprietary Sourcing Network

We proactively leverage our network to source off-market opportunities. This gives us access to transactions in fragmented asset classes and generates deal flow.

In-house Planning Expertise

We have an experienced, in-house development team to manage consultants and oversee entitlement. This ensures that we optimize the planning and application process for our development projects.

On Track to Success